A Biased View of Mileagewise - Reconstructing Mileage Logs

A Biased View of Mileagewise - Reconstructing Mileage Logs

Blog Article

Mileagewise - Reconstructing Mileage Logs Can Be Fun For Everyone

Table of ContentsAn Unbiased View of Mileagewise - Reconstructing Mileage LogsThe 6-Second Trick For Mileagewise - Reconstructing Mileage LogsMileagewise - Reconstructing Mileage Logs Fundamentals ExplainedThe Ultimate Guide To Mileagewise - Reconstructing Mileage LogsThe Ultimate Guide To Mileagewise - Reconstructing Mileage LogsAn Unbiased View of Mileagewise - Reconstructing Mileage Logs

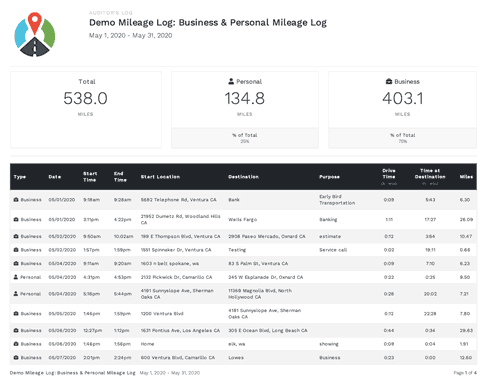

We'll study each further. Service gas mileage trackers are important to a cents-per-mile reimbursement program from a couple easy factors. Workers won't get their compensations unless they send mileage logs for their service journeys (mileage tracker). Second, as previously stated, while manually taping gas mileage is an option, it's time consuming and subjects the business to gas mileage scams.While a normal gas mileage reimbursement can be run with hand-operated mileage tracking, a FAVR program needs an organization gas mileage tracker. The thinking is basic. FAVR compensations are details per specific driving worker. With the ideal carrier, these prices are determined with a platform that connects business gas mileage trackers with the information that ensures reasonable and exact mileage reimbursement.

This confirms the allocation quantity they get, making certain any kind of amount they get, up to the Internal revenue service gas mileage rate, is untaxed. This likewise shields business from possible gas mileage audit risk., likewise referred to as a fleet program, can not possibly have requirement of a business mileage tracker?

The Main Principles Of Mileagewise - Reconstructing Mileage Logs

, "An employee's individual use of an employer-owned vehicle is considered a component of an employee's taxable income" So, what takes place if the staff member doesn't maintain a record of their organization and personal miles?

The majority of service gas mileage trackers will have a handful of these attributes. A smaller number will have them all. That does not assure they provide each attribute at the same level of quality. It must come as not a surprise that mileage automation tops this checklist. At the end of the day, it's one of the greatest advantages a company gets when taking on a service gas mileage tracker.

The 7-Second Trick For Mileagewise - Reconstructing Mileage Logs

(https://anotepad.com/notes/nfgjwnhd)If the tracker enables workers to submit insufficient gas mileage logs, then it isn't executing as required. Some trackers only require one tap to record a day of service driving. Places, times, odometer record, every one of that is logged without extra input. The application will certainly even acknowledge when the car has actually stopped and ended the journey.

Mobile workers can include this information at any time prior to submitting the gas mileage log. Or, if they recorded an individual journey, they can eliminate it. Submitting gas mileage logs with a service gas mileage tracker ought to be a wind. When all the details has been added appropriately, with the best tracker, a mobile worker can send the gas mileage log from anywhere.

Mileagewise - Reconstructing Mileage Logs for Beginners

Can you envision if a service mileage tracker application captured every solitary journey? There's no damage in capturing individual journeys. With the ideal mileage monitoring app, companies can set their functioning hours.

Mileagewise - Reconstructing Mileage Logs Fundamentals Explained

This application functions hand in hand with the Motus system to ensure the precision of each mileage log and reimbursement. Where does it stand in terms of the finest gas mileage tracker?

Interested in finding out more about the Motus app? Take a tour of our app today!.

What Does Mileagewise - Reconstructing Mileage Logs Do?

We took each application to the field on a the same course throughout our strenuous screening. We checked every monitoring setting and changed off the web mid-trip to try offline mode. Hands-on screening allowed us to examine usability and determine if the application was very easy or difficult for workers to utilize.

: Easy to useAutomatic mileage trackingMinimum tracking speed thresholdSegmented monitoring Easy to create timesheet reports and IRS-compliant gas mileage logsOffline mode: Advanced tools come as paid add-onsTimeero covers our list, thanks to its ease of use and the performance with which it tracks gas mileage. You do not require to purchase pricey gadgets. Just demand staff members to mount the mobile app on their iOS or Android mobile phones which's it.

Report this page